The U.S. electric utility sector is again rewarding CEOs with larger compensation packages, after a slight dip in 2020, and the pay gap with median employees is increasing, according to a Utility Dive analysis of nearly 40 major investor-owned utilities across eight years. A decline in median employee pay is driving the widening pay ratio, which could indicate that a higher-paid, more-experienced workforce is retiring.

In addition, as the utility sector adapts to the global push for decarbonization, regulators and shareholders alike are focused on how CEOs are steering utility businesses, which historically have been slow to change. Along these lines, some activist investors are pressing to link CEO compensation to utility decarbonization efforts.

Only one U.S. investor-owned utility has reported linking the two so far.

While the average utility CEO typically sees an annual increase, executive compensation is crafted to not raise any eyebrows, said Albert Lin, executive director of Pearl Street Station Finance Lab, given the regulatory oversight the companies are subject to.

“I think that culture [of regulatory oversight] naturally lends itself to [utilities] being experts and also knowing how to compare themselves to other, let’s say, S&P investment-grade-rated companies. Like, they will not have compensation packages that are way out of bounds or on the extreme, either low or high,” Lin said.

Utility Dive looked at annual Securities and Exchange Commission filings and proxy statements to track CEO compensation since 2014. The editors also examined the CEO pay ratio, which public companies report annually in DEF-14A forms. Pay ratios compare the total compensation of the CEO to that of the company’s median employee. The latest DEF-14As refer to fiscal year 2021.

For the purposes of this analysis, Utility Dive defined small utilities as companies with less than $5 billion total revenue in 2020, medium utilities as those with $5 billion to less than $10 billion in total revenue, and large utilities as those with $10 billion or more in annual revenue.

In addition to showing an increasing pay ratio between CEOs and their median employee, the SEC data reveal several other trends and findings.

CEO transitions or other big events, such as exiting a bankruptcy proceeding, can create compensation package outliers

Pacific Gas & Electric Co. has seen the most turnover in its CEO position among the companies Utility Dive evaluated for this analysis. The turnover largely stems from the company’s bankruptcy proceeding, according to financial analysts that track the company. While CEO Patricia Poppe received $51.2 million in total compensation in 2021 — almost double the compensation offered at any other company Utility Dive analyzed over the past eight years — tens of millions of dollars of that was made up of illiquid stock options, according to analysts.

The largest CEO compensation package last year went to Patricia Poppe, CEO of Pacific Gas & Electric Co., as of January 2021

Large utility company CEO compensation in millions of dollars, 2014-2021

Changes in leadership — including several retirements, such as that of Xcel Energy’s former longstanding CEO, Ben Fowke — can result in dips in top executive compensation, temporarily disrupting an otherwise consistent growth trend. Since 2016, at least 24 of the 39 utilities Utility Dive tracked for this analysis changed their CEO; 13 of them made changes since the start of the pandemic.

CEO transitions largely account for significant increases in the top compensation packages for CEOs at medium-sized utilities as well. CenterPoint Energy replaced an interim CEO with David Lesar in 2020, and last year Lesar received a retention incentive agreement valued at $25.24 million, giving him the largest total compensation package among the medium-sized utilities.

CenterPoint Energy CEO David Lesar had the largest total compensation package among medium-sized utilities in 2021

Medium-sized utility company CEO compensation in millions of dollars, 2014-2021

Other notable increases can mark significant milestones for a company, such as the M&A transactions that resulted in the creation of Evergy from the merger of Westar Energy and Great Plains Energy in 2018. The total CEO compensation for that CEO more than doubled from 2017 to 2021, making it the second-highest compensation package in 2021 for CEOs at small utilities Utility Dive studied.

Even setting aside the CEOs at companies that experienced significant milestones or recent CEO changes, CEOs at many smaller utilities saw their total compensation increase in 2021 after dips in 2020.

CEO compensation increases can also indicate the utility hitting significant milestones, such as the successful M&A transactions by Evergy

Small utility company CEO compensation in millions of dollars, 2014-2021

Overall, the pandemic and the commensurate economic downturn did not necessarily lead to lower compensation for utility CEOs in 2020 and 2021, Lin said. “I think most utilities have shown a level of resilience and ability to generate profits that maybe would have defied what most people thought was an economic downturn, or even an economic gut punch that many other industries were struggling with,” Lin told Utility Dive. In retrospective reports, other analysts agreed with that assessment.

Experts on executive hiring said a lot of competition exists for the generally small pool of executives qualified to lead electric utilities.

ERI Economic Research Institute’s analysis has found a high correlation between the total revenue of a company and its executive compensation, according to ERI data analyst Katie Sebastian.

For the most part, electric utilities work to ensure their CEOs’ pay remains competitive with other utilities of a similar size and revenues, thus creating a steady increase in executives’ total compensation packages. This also led to flat salary increases, particularly at the start of the pandemic, for companies that didn’t experience changes in CEO leadership, according to Sebastian.

Before the pandemic, larger utility companies were more likely to have outlier compensation packages

Total compensation packages of utility CEOs in millions of dollars compared with the total revenue of the company in 2019 in billions of dollars

A rising pay gap may signal the exit of an aging workforce

According to Utility Dive’s analysis of median employee pay since that data became available, median employee compensation has increased, often along with CEO compensation, but at a slower pace.

Under the Dodd-Frank Act, since 2017, companies have been required to report to the Securities and Exchange Commission the ratio between executive pay and compensation for the median employee. That figure, analysts say, can reflect a number of trends in the workforce, including a larger rate of utility employee retirements.

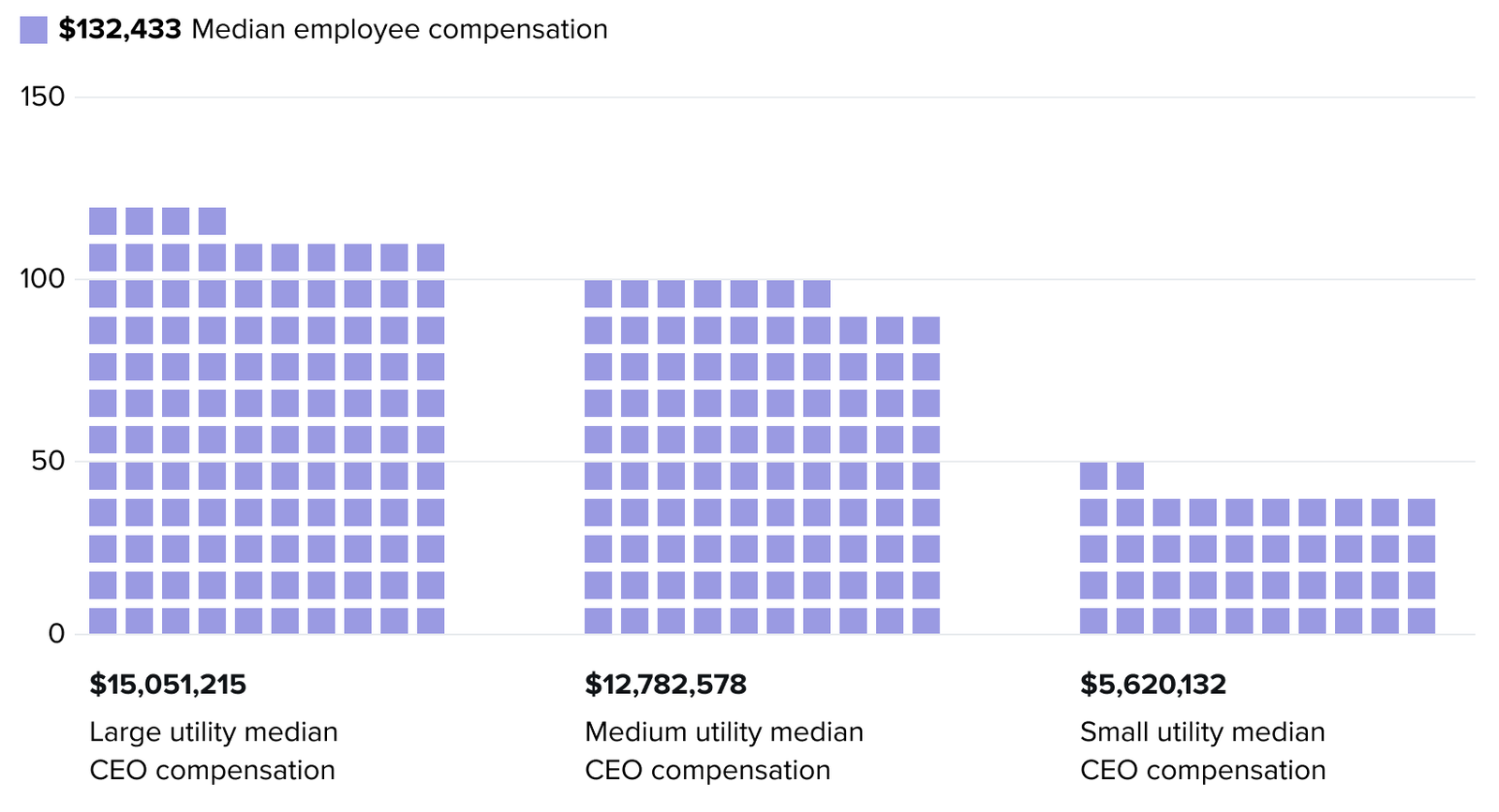

Across the sample of 39 investor-owned utilities Utility Dive analyzed, the overall median of all the individual median pay numbers went from $124,729 in 2017 to $132,433 in 2021. However, the year-over-year analysis shows a 5.6% dip from 2020, when median employee pay was at $140,300 for those companies, to 2021.

For all utilities, “average pay stayed pretty stable [throughout the pandemic]. I don’t think you’re gonna find that it dramatically moved one way or another,” Lin said of median employee pay.

But several utilities — especially larger companies such as Duke Energy, Pacific Gas & Electric and NextEra Energy — saw a widening gap between CEO and median employee pay in 2021 compared with pre-pandemic times, according to Utility Dive’s data.

With larger companies, CEO compensation packages can be over 100 times the median employee compensation

Ratio of median employee compensation to CEO compensation at utility companies in 2021

Julia Himmel/Utility Dive; Source: Utility company annual filings, proxy statements and DEF-14A forms

In 2021, two California-based investor-owned utilities offered their CEOs more than 190 times the total annual compensation of their median employee.

However, the growing pay ratio does not necessarily mean employee pay is being lowered, according to the Utility Workers Union of America, especially in a time when electric utility workers are essential.

“Our members did not experience a drop in pay in 2021,” Erin Bzymek, spokesperson for the AFL-CIO union, said in an email. “In fact, we continued to bargain strong contracts and strong wage increases for our members last year.”

Instead, the rising pay gap could speak to the exit of an aging workforce, ICF Senior Fellow Val Jensen said.

“The highest-paid employees will be generally the ones that have had the most experience, and, anecdotally, I know a lot of utilities are experiencing a wave of retirements in recent years, including my own,” Jensen, a former Exelon executive, said.

There are exceptions to the broader trend of increasing pay ratios.

Utility Dive found examples, especially among larger utilities, of the pay gap shrinking from 2019 to 2021, which analysts attributed to a variety of factors. For example, Xcel Energy’s CEO pay ratio narrowed from 150 to 1 in 2019 to 139 to 1 in 2020 and 95 to 1 in 2021, reflecting the exit of longtime CEO Ben Fowke while median employee compensation rose from $113,022 in 2019 to $122,532 last year.

Retirements may be driving down the average median employee compensation, widening the pay gap between median employee and CEO

Average CEO and average median employee compensation in dollars, 2021 and 2020

While the pay gap remains wide for many investor-owned utilities, utility employees earn a relatively high salary compared with employees in other sectors.

The median employee at a utility is likely to have a higher average salary than one at a non-electric utility company in the investment-grade portion of the S&P 500, Lin said. The utility culture of “a regulated and more stable industry leads to overall higher-than-average compensation,” he said.

“Utilities experience slower rates of change, and that affords them the ability to invest in their employees,” unlike employers in industries that have high turnover rates, he said.

Utility employee compensation may also get a boost from current labor market dynamics. “In some parts of the country, there are real shortages of skilled workers, and companies are going to have to increase those wages to attract workers,” said Allan Marks, a partner in the Los Angeles office of Milbank LLP.

From compensation to decarbonization

In recent years, an increasing number of electric utilities have pledged to drastically curb their carbon emissions. Some activists have criticized such goals as nominal, however, noting that utilities are continuing to propose building new gas generation in the short term.

Executive compensation has been used as a marker for various analyses of company success, and shareholder advocacy groups, including As You Sow, have been advocating for utilities to use executive incentives to push companies toward decarbonization.

The Energy and Policy Institute, a watchdog organization, published a report in 2020 analyzing the 2019 CEO compensation packages of 19 investor-owned utilities, examining whether any of the utilities linked compensation to performance on their emissions goals. Among the utilities the institute studied, the only one that did so was Xcel Energy, one of the first utilities to publicly announce a full decarbonization goal.

In its report, EPI said statements of intent on decarbonization in company sustainability reports did not necessarily lead to action.

However, environmental, social and corporate governance factors must first be part of a company’s strategy — to help drive shifting priorities — before a board can link them to executive pay, according to PricewaterhouseCoopers analysts.

More and more, issues of decarbonization are top priorities for utility leaders, ICF’s Jensen said, noting a June 2022 survey of utility executives in which 88% of respondents said climate change resilience is a moderate or high priority for their organization.

”What we’re seeing is a shift from the consideration of goals and targets to actionable steps,” including the development of metrics and grid resiliency solutions, he said.