The following is a contributed article by Jeremy Fisher, Senior Advisor for Strategic Research and Development, Environmental Law Program, The Sierra Club

Rural electric cooperatives hold a unique place in the U.S. electric sector. Authorized under the Rural Electrification Act (REA) of 1936, the formation of non-profit electric cooperatives is a lasting legacy of the last New Deal. Unfortunately, federal support of these cooperatives has not kept up with the times, and today rural utilities hold a disproportionate amount of uneconomic coal in the United States.

With that in mind, we’ve put a proposal on the table to use federal dollars to ease the transition from fossil fuels to clean energy at cooperatives and coal communities by injecting $12.5 billion of clean energy dollars into rural economies, with an additional $2.5 billion for plant and coal mine communities.

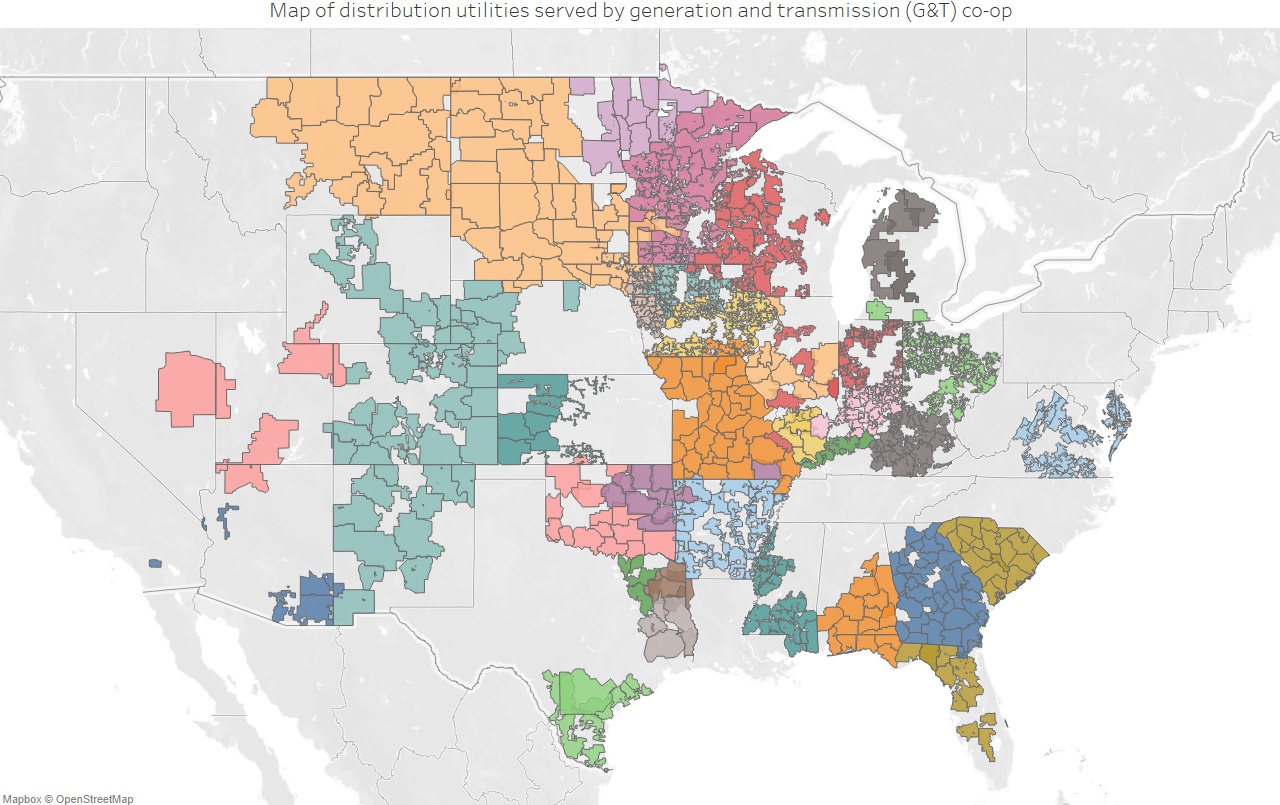

Today, local distribution cooperatives, ranging in size from several hundred customers to hundreds of thousands, serve about 13% of load in the U.S. and the vast majority of rural America. Most distribution cooperatives procure energy, transmission services, and often other energy services from generation and transmission cooperatives (G&Ts). Those G&Ts are, in and of themselves, not-for-profit organizations owned by the cooperative utilities.

Cooperatives serve rural residents, industries and farms — places ripe for the next clean energy cash crop. More than 90% of persistent poverty counties are served by rural cooperatives, and these parts of the country are more likely to experience high energy burdens, meaning a greater percent of a household’s income is spent on electricity.

Cooperatives lag other utility providers in transitioning from coal to clean energy

Nearly a quarter of all energy served to rural electric cooperatives is derived from coal, and the cooperatives lag in replacing coal with clean energy relative to other utilities.

Permission granted by Sierra Club

This slow pace of transition has meant that rural cooperatives are hit by higher energy costs. Cooperatives serve customers in 47 states; in 2019, the average cost of energy was higher for cooperatives than investor-owned utilities (IOUs) in 39 of those states (derived from EIA Form 861, 2019). In those states, energy is almost 23% more expensive than at IOUs.

So what’s stopping rural cooperatives from competing in the clean energy transition?

The perception — and reality — that real jobs are at stake. Even with the promise of lower cost energy, replacing a job today with a potential job in the future is a hard sell. Without a clear means of transition assistance, coal communities become just another part of America left behind.

An inability to tap critical tax credits for wind and solar energy. While for-profit IOUs and private developers can often find a use for a clean energy tax credit, the same isn’t true for non-profit cooperatives.

A substantial debt load from coal plants. Coal plants are expensive, and in addition to expensive pollution controls, have required a continuous stream of new capital investment to keep them running. Like IOUs, cooperatives are at risk of holding stranded coal assets, where a coal plant’s “book value” is greater than its market value. “Book value” is the undepreciated portion of an asset’s capital cost. In rough terms, it can be thought of as equivalent to the principal that hasn’t yet been paid off on a mortgage. And like a house, an asset’s owner is in trouble when the amount of principal yet to be paid is greater than the value of the asset to the market. In housing terms, it might be called a mortgage that’s underwater. But unlike IOUs, those coal plants may be the collateral on G&T debt which, ironically, makes retiring them a risk to lenders.

All three of these issues need to be addressed to have an effective transition that puts communities first.

Permission granted by Sierra Club

Today, 35 rural G&Ts — serving nearly 10 million residential customers — collectively hold 25 GW of coal in 92 different plants. We estimate that G&Ts hold between $15 and $17 billion in undepreciated coal plant balances.

(Why just an estimate? Because in another space where cooperatives differ from other utilities, there are no uniform reporting standards for cooperatives. Some produce detailed annual reports and audited financial statements, some report to the SEC, and some produce almost no public records at all. In this particular twist, member-owned cooperatives are sometimes almost impossible to penetrate by their very own members.)

That means that the utilities’ represent those plants as holding value on their books. But while these plants still provide services to the utility, many are uneconomic (i.e. their customers are paying more for coal than they would for alternative energy sources), and hold little or no market value.

Changing the equation: A proposal

So how do we help rural G&Ts overcome this debt load, accelerate the transition to clean, and ensure that this transition supports communities impacted by plant retirements? Here we offer a proposal for rural energy relief, a program that could be tied into the administration’s existing rural infrastructure plan.

The general outline is that the USDA, which already administers loans and grants to rural electric cooperatives, would structure a new class of grants or forgivable loans, with guide rails and milestones to ensure utilities use the money responsibly.

Our proposal includes two key components:

First, for every kilowatt of coal capacity retired by the end of 2026 and replaced with local clean energy resources, the USDA would provide $500 of debt relief, up to $12.5 billion nationally. At this level of relief, the remaining debt load of coal plants evaporates for some utilities, and is substantially shrunk for other utilities. The influx of funding would go directly to lower cost clean energy (solar, wind, storage, demand-side management and transmission), which would not only lower rates but ensure that the economic opportunity of this refresh happens within the communities that are served by the G&T. To protect customers, cooperatives would have to show that the program is resulting in net cost savings to customers. Importantly, this program isn’t a mandate: utilities would have the flexibility to provide the services that are needed to serve their customers, at a level that works for their customers and communities.

Second, utilities could elect into another $100/kW of federal support for coal community transition funding, up to $2.5 billion nationally. To ensure that the communities impacted by plant retirements are treated equitably, this program would funnel transition funding directly to coal communities that have served our energy system. To put this number in perspective, a thousand megawatt plant would see $100 million of transition dollars flow to that community, in a process worked out between the utility and the impacted communities. Transition dollars are a down-payment to support pensions, job retraining or transfer, wage support, attracting new businesses, or supporting the tax base of impacted communities.

Meeting cost and reliability challenges

Change is never easy, particularly when it affects people’s jobs and communities. Likewise, the fossil fuel industry maintains a message in rural America that clean, renewable energy is expensive or unreliable.

On the cost end, technological advances of the past few years now mean that wind and solar are the cheapest cost of new energy, and portfolios of clean energy outcompete new gas plants in the U.S. Similar analysis has found that building new wind and solar plants is often less expensive than continuing to operate existing coal-fired power plants.

Operators are also showing that our grid can handle deep penetrations of renewable energy while maintaining reliability. New in-depth modeling shows that the U.S. can drive to a 90% clean electricity target by 2035 with today’s technologies, realize substantial economic and health benefits, and meet climate commitments, all while maintaining a reliable grid under extreme weather and low renewable generation conditions.

The impact of coal transition funding

Ultimately, the proposed program to support transitioning rural electric cooperatives from coal to clean energy could have a substantial positive impact in driving re-investment in rural areas. We are not alone in this thinking, as outlined in a 2019 rural electrification report from CURE, Center for Rural Affairs, and We Own It, and demonstrated more recently by Tri-State Generation and Transmission Association’s interest in coal debt relief for electric cooperatives; Tri-State is the third-largest G&T by annual revenue.

If the energy and capacity services provided by the coal plants to America’s G&Ts were replaced by clean energy, our proposed program could drive 60 GW of solar and wind, and nearly 20 GW of storage build in rural communities — a cost-effective investment of nearly $80 billion. (Values are from a tool derived from Rocky Mountain Institute’s Clean Energy Portfolios development tool, focused on the performance and services provided by coal plants.) That investment in clean provides lower cost energy than the all-in forward going cost for many of these coal plants.

The availability of lower cost clean energy not only supports today’s customers, but attracts corporate buyers who are increasingly interested in clean energy. It reduces the risk of future stranded costs, allows utilities to avoid expensive future environmental compliance obligations for plants that still need pollution controls, and positions G&Ts competitively in today’s energy market. In total, the program could reduce emissions by 200 million tons of CO2 per year.

This is a unique opportunity to allow rural electric cooperatives to realize the opportunities in clean energy development, and retake a position as member-focused and driven stewards for their communities.