Dive Brief:

- The Independent System Operator for New England (ISO-NE) highlighted the shift in its evolving resource mix toward distributed systems, renewables and natural gas in its 2019 Regional Electricity Outlook, released on Wednesday.

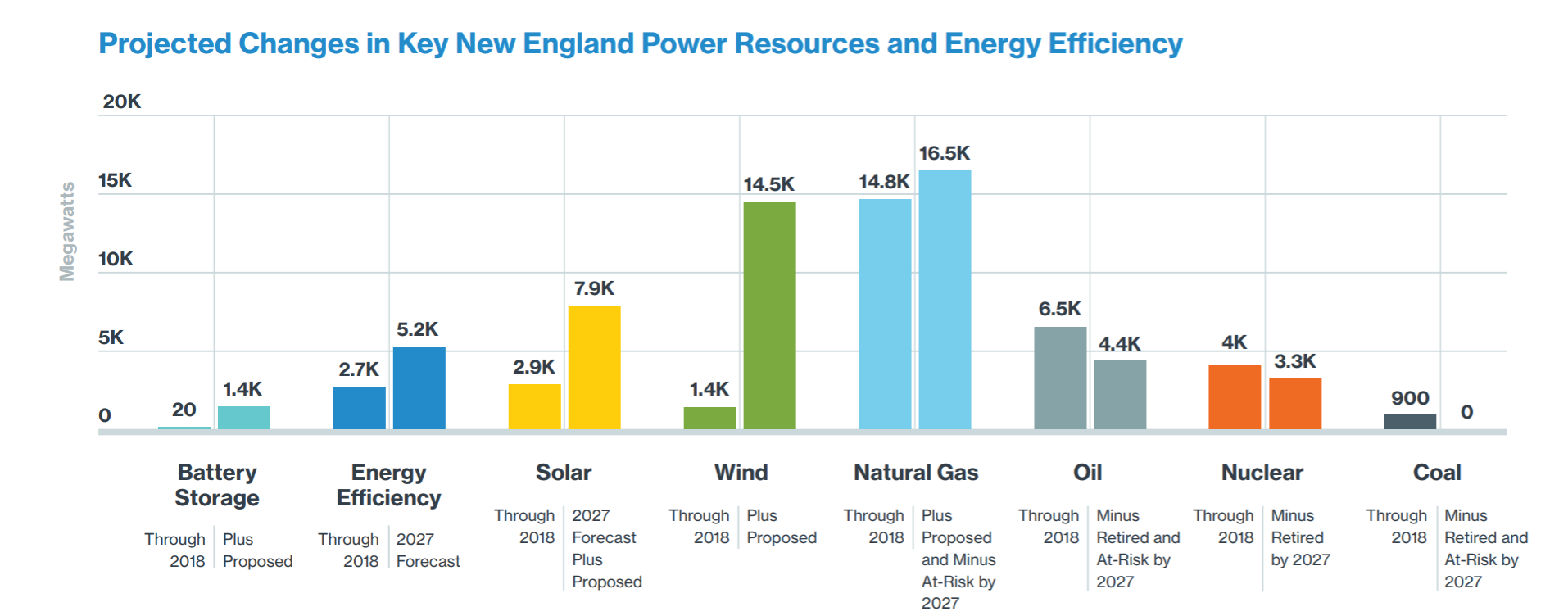

- The grid operator forecast a decreasing net load as behind-the-meter resources increase. The region has nearly 3 GW of energy efficiency measures to reduce demand on the grid and about 2.9 GW of behind-the-meter solar photovoltaic resources.

- While peak demand in 2018 climbed to a five year-high in the region, the outlook showed less efficient resources are retiring or facing early retirement.

Dive Insight:

The shift from centrally-dispatched generation to distributed resources has coupled with the trend toward renewable energy to create a hybrid grid. As a further testament to the change, last month, ISO-NE became the first capacity market to accept an aggregated residential solar-plus-storage bid, for 20 MW. The distributed resources are “creating new complexities in daily load forecasting,” Marcia Blomberg, spokesperson for ISO-NE, told Utility Dive via email.

ISO-NE estimates energy efficiency measures will save an average of 2,059 GWh and reduce peak demand by 281 MW annually through 2027. The 2018 peak demand was over 25 GW, the highest it’s been in five years.

“Changes in peak demand (rather than net load — which is total annual energy usage) have a greater effect on reliability,” Blomberg said. “If demand peaks higher than expected, the grid operator must quickly dispatch more resources to come online to meet the higher-than-expected … demand.”

A separate report released by ISO-NE in February, State of the Grid 2019, focused on the shift from “on-site fuel” to “just-in-time” fuel (like natural gas), distributed resources and renewable energy.

The regional outlook released yesterday also notes fuel delivery challenges with liquefied natural gas (LNG), leading to fuel constraints during winter for gas-fired power plants. Natural gas constraints during the extreme cold spell that started last Dec. 26 led to high use of oil generation — 25% of the regional fuel mix. As in 2013 and 2014, winter-time gas constraints made oil generation more economic.

LNG fuel constraints and prices coincide with wholesale power price spikes.

ISO-NE

Of the conventional generation on the grid, more than 5.2 GW of oil, coal and nuclear power will be retired from 2013 to 2022, and 5 GW of coal and oil generation remains at risk of retiring in the coming years, ISO-NE said.

But the Millstone and Seabrook nuclear power plants, combined for 3.3 GW, “will be critical components of the hybrid grid” as a clean, dependable, baseload fuel supply, the outlook states. The Nuclear Regulatory Commission is expected to address a license extension of NextEra Energy Resources’ Seabrook plant through 2050. Meanwhile, Dominion Energy has warned of closing the Connecticut-based Millstone plant, and is working to reach an agreement with Eversource and United Illuminating over power prices by March 15. Connecticut regulators have worked in the last year to keep the plant open.

New technologies in battery storage, energy efficiency, offshore wind and other solar is expected to make up the energy mix in the future, as every coal generator is at risk of retirement by 2027.

ISO-NE 2019 REO

The ISO’s generation interconnection queue forecasts over 20 GW of proposed capacity, of which 13.46 GW represents wind power.

States in the region have increasingly focused on developing renewable and clean energy resources, although 3.16 GW of natural gas in the queue shows that fossil fuel-burning generation remains competitive. The grid operator noted that 70% of proposed new projects end up being withdrawn, historically.