Gaps in resource procurement by California’s proliferating load serving entities (LSEs) could prevent the state from achieving its nation-leading renewable energy and climate goals.

The state’s massive renewable resource portfolio has gaps in it that threaten the reliable delivery of electricity, according to a March 18 proposed decision in the California Public Utilities Commission (CPUC) integrated resource planning docket. The docket was designed to address reliability in planning by assuring that variable resources are adequately balanced by resources that are available when needed.

The CPUC must decide whether the LSEs‘ combined plans will deliver “a reliable and affordable electric system” while meeting California’s mandated climate goals, Administrative Law Judge Julie Fitch wrote in the March 18 proposed decision.

That will require balancing “existing and new resources” with “baseload and intermittent resources” made up of “renewable, storage, and conventional fossil-fueled resources,” Fitch wrote. In the LSEs‘ filings, “there is inconsistent, and in some cases, nonexistent, recognition of these realities.”

Participants in the planning process were concerned that California was going off course, until agreement began to emerge that Assembly Bill (AB) 56’s “backstop procurement entity” points toward a solution to the gaps in procurement. The bill got a big boost when an April 12 report from Governor Gavin Newsom’s specially-appointed “Strike Force” endorsed the backstop concept as a way to make procurement more efficient.

IRPs collectively deficient

In 2015, California had three investor-owned utilities (IOUs), two community choice aggregation (CCA) programs and a few electric service providers (ESPs), but over 40 LSEs’ filings were evaluated in Fitch’s proposed decision. Many factors contribute to the gaps in procurement, but the key is this proliferation of California LSEs.

IOUs have not been procuring new generation because their customers are departing to community choice aggregators (CCAs) and electricity service providers (ESPs). But many LSEs are new and still getting financial and organizational foundations in place for procuring generation, many stakeholders, including CCA spokespeople, told Utility Dive.

With these changes impeding progress, prospects for meeting California’s 60% by 2030 Renewable Portfolio Standard (RPS) and its aspirational, economy-wide zero greenhouse gas (GHG) emissions by 2045 goal are threatened, despite some smaller LSEs procuring more aggressively, stakeholders told Utility Dive. Reliability remains the big concern.

When procurement was largely shared by Pacific Gas and Electric (PG&E), Southern California Edison (SCE) and San Diego Gas and Electric (SDG&E), each managed reliability in its territory. With procurement now disaggregated among many locally-focused LSEs, and levels of low-cost wind and solar rising, the system’s needs are evolving.

“There is no crisis now, but we need to get ahead of this dynamic and evolving market with a plan that is robust and adaptable because making policy in a crisis almost guarantees a bad result.”

Matt Freedman

Senior Staff Attorney, The Utility Reform Network

Firm resources like geothermal, biogas, pumped hydro and types of storage are needed to replace natural gas generation by 2030, studies from California agencies and research groups have reported. But those technologies are not yet cost-competitive, and CPUC analyses show they are not being procured by the new, cost-minded LSEs, which insist on making independent procurement decisions.

Fitch’s proposed decision opens a “procurement track” to study new reliability solutions. With PG&E in bankruptcy and all three IOUs facing another potentially catastrophic wildfire season, the legislative solution offered in AB 56 may be a faster track to reliability, spokespeople for IOUs, CCAs, ESPs and power providers told Utility Dive.

California’s procurement controversy

Disaggregation of generation procurement has led to controversy over whether the procurement process itself can be improved.

There are now 19 CCA programs serving over 10 million former customers of investor-owned utilities. Ten of them emerged in 2018. The CPUC expects CCAs to serve over 80% of IOUs’ current customers by the mid-2020s. There are 21 CPUC-registered ESPs now serving commercial-industrial (C&I) customers. Senate Bill 237, passed last August, increased ESPs’ allowed share of IOU C&I load to 15.4%.

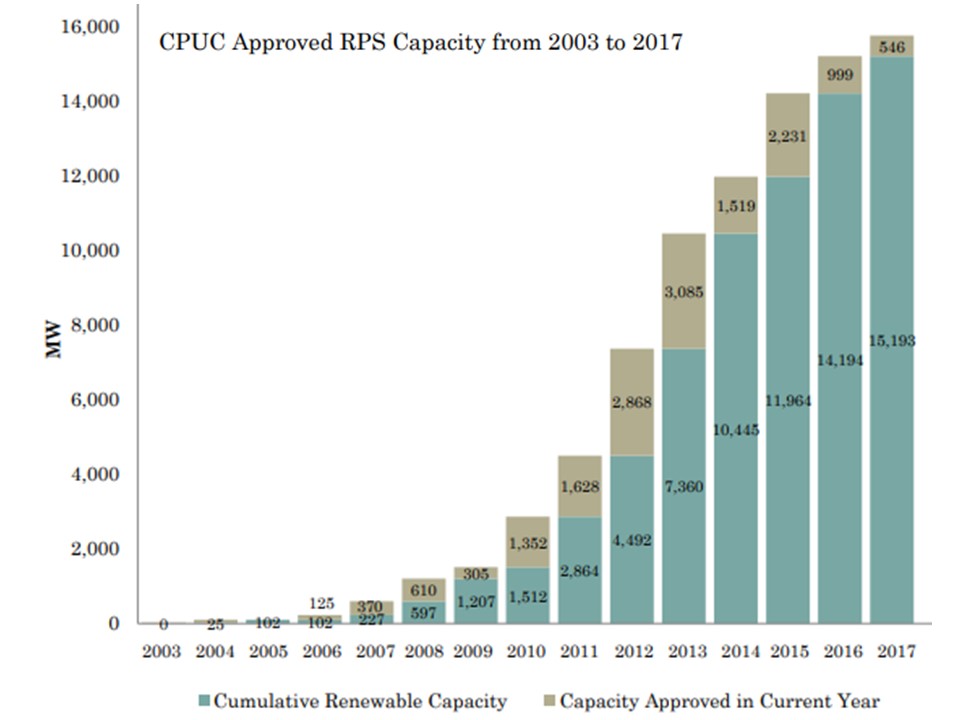

Because of the rapid emergence of these LSEs, IOUs did not procure new renewables in 2016, 2017 or 2018, but have adequate contracted capacity to meet most of their 2030 RPS obligations, according to the CPUC’s November 2018 RPS report. CCAs and ESPs, though, “have an immediate RPS procurement need of approximately 6,900 GWh beginning in 2020.”

Procurement by ESPs lags most. “Every CCA in California plans to procure more renewables than is required under the RPS, and sooner,” East Bay Community Energy (EBCE) CEO Nick Chaset reported in January.

But CCA and ESP procurement patterns to date have been inadequate, SCE VP for Energy Procurement and Management Colin Cushnie told the California Senate Energy Committee March 19. “This is just untenable,” he said.

“The pieces did not add up to the whole we were trying to plan for to meet the state’s 2030 GHG reduction targets.”

Liz Anthony Gill

Grid Policy Director, Center for Energy Efficiency and Renewable Technologies

Administrative Law Judge Fitch agreed. “The individual resource choices by the LSEs collectively did not result in a diverse and balanced portfolio of resources needed to ensure a sufficiently reliable or environmentally beneficial statewide electricity resource portfolio,” she concluded.

“The pieces did not add up to the whole we were trying to plan for to meet the state’s 2030 GHG reduction targets,” Center for Energy Efficiency and Renewable Technologies (CEERT) Grid Policy Director Liz Anthony Gill told Utility Dive. For near-term planning, Fitch’s proposed decision ordered the use of an “optimized” resource portfolio developed early in the IRP process before LSEs submitted their plans, with procurements and costs allocated by the CPUC.

A centralized procurement process

The new IRP “procurement track” will study ways higher capital cost, zero emissions resources, like geothermal, offshore wind or pumped hydro storage, can be acquired to benefit the system, she added. “One possible solution is a central procurement entity.”

Data on CCA procurements shows a need for a solution to meet California’s 2030 renewables goals, Matt Freedman, senior staff attorney for ratepayer advocacy group The Utility Reform Network (TURN) told Utility Dive in an email. There are new long-term renewable energy contracts from only a small number of CCAs and many new CCAs “have yet to announce contracts for new resources,” he found. CEERT’s Anthony Gill agreed.

But CCAs are optimistic they can comply with any renewable requirements.

CCAs are governed by “local elected officials on our governing boards, but we are subject to CPUC jurisdiction and required to submit plans under the IRP,” EBCE Senior Director of Public Policy and Deputy General Counsel Melissa Brandt told Utility Dive. “There was a two-to-three-year procurement lull during the transition from IOUs, but we are on track to meet state mandates.”

CCAs “absolutely want to protect system reliability, but we also want to protect LSE’s right to self-procure,” she added.

Other stakeholders in the IRP process endorse LSEs’ right to procure independently, but are concerned about the gaps in procurement identified in ALJ Fitch’s proposed decision that were once filled by IOUs.

IOU “operational resources and balance sheets” have been used to meet state mandates, and LSEs have “the same obligation,” SDG&E VP for Energy Supply Kendall Helm told the Senate Energy Committee March 19. But gaps due to “decentralized decision making” could be filled by “a state Special Purpose Entity (or central buyer).”

AB 56 proposes “a tool in the regulatory agencies’ tool box to ensure California meets its renewables and climate goals without threatening system reliability or increasing ratepayers’ bills.”

Eduardo Garcia

California Assembly Member

CCAs can support a central buyer if it is limited to “residual central procurement” so that “LSEs would do their own procurement and the entity would fill the remaining gaps,” Brandt said.

California Assembly member Eduardo Garcia‘s AB 56 proposes that kind of entity. “It is ‘backstop’ procurement,” Garcia told Utility Dive. It would not impede individual LSEs, but “would be a tool in the regulatory agencies’ tool box to ensure California meets its renewables and climate goals without threatening system reliability or increasing ratepayers’ bills.”

Growth dropped sharply after IOUs stopped procuring in 2016.

The backstop

AB 56’s California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA) would be “a backstop procurement entity,” said TURN’s Freedman. TURN is a Garcia bill stakeholder sponsor.

“The public, non-profit corporation would be governed by a publicly-appointed board and procure for all retail electricity customers,” he said. “But only if the CPUC or the California Energy Commission (CEC) identified procurement needs and allocated it that responsibility.”

The Garcia bill backstop entity “is unique to California,” Freedman added. But similar procurement approaches are working in Illinois and New York and by the state-regulated Efficiency Vermont.

“All procurement would be reviewed and approved by the CPUC or CEC, both in advance of and after it is identified,” Freedman said. “Some people suggest it could go rogue, do whatever it wants, and send the bill to the state, but the Garcia bill expressly prevents that.”

With agency approval, CAEATFA could do five types of procurement. It could procure to meet state mandates or a Resource Adequacy program need for local reliability. Third, it could fill gaps left by LSE IRP plans. Fourth, it would allow LSEs to pool resources for RPS procurements. Finally, it could manage abrogated IOU generation contracts, such as from a bankruptcy.

Another advantage of the Garcia bill entity would be its ability to leverage state funds, incentives and public financing mechanisms to minimize LSE costs, which would lower customer rates, Freedman said. CAEATFA would also relieve IOUs of backstopping reliability and allow refocusing on “their distribution and transmission assets and their customer facing services.”

Critically, the entity would protect the autonomy of CCAs and ESPs to procure independently in the absence of a reliability need identified through a public regulatory proceeding, he stressed.

“Our understanding is that the proposal in the Garcia bill is intended to be for a residual central procurement entity. We are going to work with Assemblyman Garcia’s office to clarify that.”

Melissa Brandt

Senior Director of Public Policy and Deputy General Counsel, EBCE

This type of “backstop procurement entity” may be a solution for meeting system needs that CCAs, IOUs, generators and other stakeholders can all endorse.

“Our understanding is that the proposal in the Garcia bill is intended to be for a residual central procurement entity,” Brandt said. “We are going to work with Assemblyman Garcia’s office to clarify that.”

The Garcia bill entity is an “independent and financially viable” backstop and “limited in scope to collective deficiencies” in LSE procurements, which are prerequisites stipulated by SDG&E’s Helm in her Senate Energy Committee testimony.

But SCE and others have doubts about the viability of such a backstop.

The smaller LSEs have work ahead

Doubts

The existing mechanisms for backstop procurement have been effective, and if ESPs and CCAs allow commission oversight of their planning, “central procurement can be small,” SCE’s Cushnie told the Energy Committee. But if “city councils and county supervisor boards” continue to direct their planning, “there will be large gaps” and a “central buyer will have to do lots of procurement.”

California’s power system “needs to be centrally planned,” he insisted. “We can’t be fighting one another on that.”

A backstop procurement entity “would be an appropriate way of dealing with gaps,” Jan Smutny-Jones, executive director of the Independent Energy Producers Association(IEPA) told Utility Dive on behalf of the natural gas plant owners and utility-scale renewables project owners he represents.

“There has to be a balance between giving the backstop authority to fill gaps and leaving all procurement to it. We have some concerns that Garcia may give the backstop entity too much authority.”

Jan Smutny-Jones

Executive Director, Independent Energy Producers Association

“But some LSEs may leave procurement entirely to the backstop entity,” he said. “There has to be a balance between giving the backstop authority to fill gaps and leaving all procurement to it. We have some concerns that Garcia may give the backstop entity too much authority.”

The new LSEs are not procuring renewables “in the magnitude and volume the IOUs once did, and procurement changes could destabilize California’s power market,” American Wind Energy Association California Caucus Director Danielle Mills said. “We are looking for principles that will stabilize it.”

If AB 56’s entity “could manage existing IOU contracts in a bankruptcy, and keep procurement going, that would be valuable,” she told Utility Dive. “But there is only value if the entity simplifies procurement.”

The IRP proceeding has led to a lot of learning about planning, “and it is messy, and it needs to evolve, but it is too soon to rush to the conclusion that the process is broken,” EBCE’s Brandt said. “Central procurement is one solution. CCAs have proposed others.”

The CPUC could “just order more or different procurements if LSE plans do not meet state goals,” she said. “That is simpler. There is no need for a new state agency if the CPUC can order an LSE to obtain a certain amount of a resource at a specific location to comply with its IRP obligation.”

“There is no crisis now, but we need to get ahead of this dynamic and evolving market with a plan that is robust and adaptable because making policy in a crisis almost guarantees a bad result.”

Matt Freedman

Senior Staff Attorney, The Utility Reform Network

The Garcia bill is “jumping the gun” because the IRP proceeding has not concluded central procurement, even using a residual model, “is the only way to close gaps in LSE procurements,” Brandt said. It may be acceptable to CCAs if it does not “limit our ability to procure and it addresses only the unmet need.” But, first, the CPUC “must clearly establish a need and give LSEs an opportunity to procure.”

The Garcia proposal “will expand a discussion that has been going on in California for years about some kind of backstop procurement entity” to head off any reliability crisis caused by disaggregated procurement, TURN’s Freedman said. “There is no crisis now, but we need to get ahead of this dynamic and evolving market with a plan that is robust and adaptable because making policy in a crisis almost guarantees a bad result.”

With increased uncertainty from so many factors, “letting the market work could mean more of the same gaps in procurement,” Garcia told Utility Dive. New resources and technologies and new threats from wildfires and utility instabilities call for “a hands-on approach.”