When asked how to best plan for battery storage in a future power mix, utilities, resource planning consultants, and researchers had the same answer: It depends.

The key variables are the system’s current and projected renewables and storage penetrations. But drilling into the complexities of planning for the right amount of battery storage in a least-cost future resource mix dominated by renewables revealed critical insights about how to properly value storage for the reliability it provides.

Planners have made “substantial progress” in “capturing the complex value of battery storage for reliability,” National Renewable Energy Laboratory (NREL) Senior Researcher and Group Manager Daniel Steinberg said during a California Energy Storage Association (CESA) May 22 webinar. Ways to value shorter duration storage in planning are “actively being improved,” but long-duration storage methods are only “developing.”

Arizona Public Service (APS), the first investor-owned utility to choose solar-plus-storage over a natural gas peaker unit, uses “multiple future scenarios” to plan for its storage needs, APS VP for Resource Management Brad Albert told Utility Dive. “There is no perfect scenario. We could not have predicted a pandemic in 2020. Strategic planning requires judgments.”

There are conditions in which overbuilding renewables is more cost-effective than deploying storage. And the value of battery storage for reliability changes significantly as costs fall and penetrations of variable renewables and storage rise on the system. Precise analytics, like the Effective Load Carrying Capability (ELCC) calculation, could simplify planning decisions, some stakeholders said. But others said no calculation substitutes for judgment.

From bidding to planning

Though utilities have long recognized the value of pumped hydro, compressed air, and concentrating solar’s thermal storage, those technologies have not proved cost-effective and scalable for storing energy. Two recent solicitations turned planners’ attention to batteries.

First, Xcel Energy’s landmark 2016 all-source solicitation brought bids as low as $21/MWh for wind-plus-storage and $36/MWh for solar-plus-storage.

“Until about 2016, it was assumed batteries were too expensive and planners wouldn’t even include them in their modeling,” Energy Storage Association (ESA) VP for Policy Jason Burwen told Utility Dive. “Now, something like 80% of utility [resource planning] models look at storage and some are selecting purely on its cost-competitiveness.”

Xcel Energy “recently transitioned” to Anchor Solutions’ EnCompass software which allows multiple scenario, hourly modeling of storage options “for both capacity and energy arbitrage values,” Xcel VP for Strategic Resource and Business Planning Jonathan Adelman emailed Utility Dive.

Using the new tool’s modeling “for every hour of the year,” Xcel Minnesota’s 2019 long term plan included four-hour battery storage for the first time, to “help us meet our capacity needs,” Adelman said.

“A natural gas peaking unit and batteries both meet peak demand, but the batteries might save customers money by shifting low-cost midday solar to meet high-priced peak demand needs.”

Brad Albert

VP for Resource Management, Arizona Public Service

Through its 250 MW Solana concentrating solar project with six hours of thermal storage, built in 2013, APS saw “the value of storage to serve peak demand,” APS’s Albert said. It was a “huge part” of APS’ 2018 decision to choose solar-plus-storage over natural gas in an all-source solicitation.

Storage is now part of the utility’s long-term planning, but utility resource planners should “not get fixated on one scenario,” Albert stressed. “A natural gas peaking unit and batteries both meet peak demand, but the batteries might save customers money by shifting low-cost midday solar to meet high-priced peak demand needs. That extra wholesale market value is now part of our planning process.”

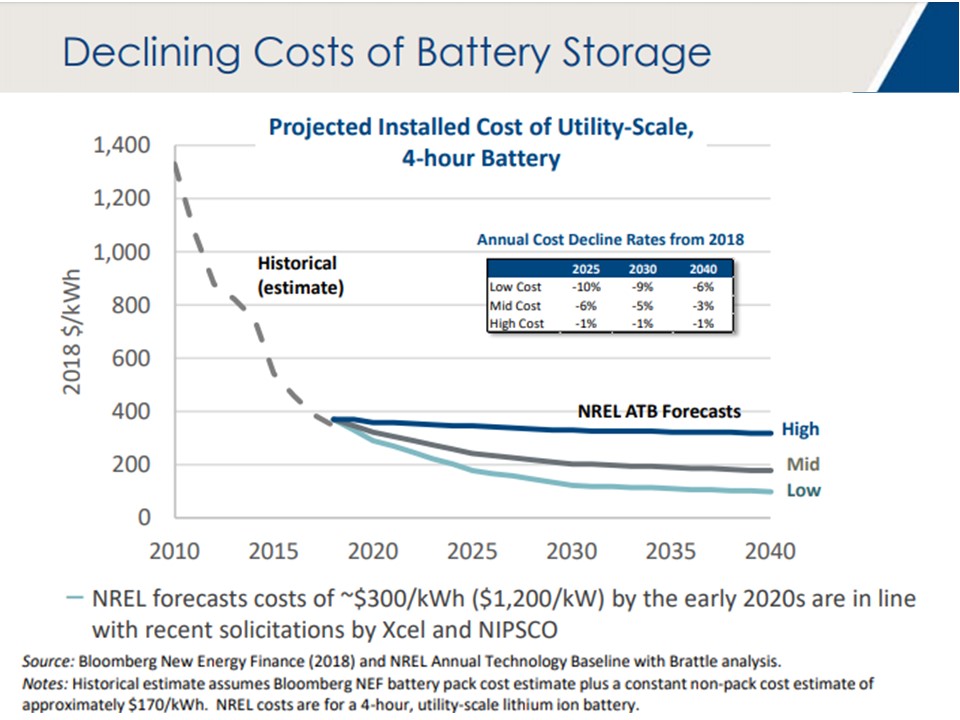

The lithium-ion battery storage capital cost has come down so quickly that it is now too low for any other technology to compete in providing reliability and grid services, according to The Brattle Group’s May 13 presentation at an MIT workshop. It dropped from $1,400/kWh in 2010 to below $400/kWh, and could reach $200/kWh or less by 2040, Brattle reported.

Permission granted by The Brattle Group

But price is not the only factor to consider in planning for storage, utility executives and authorities on planning told Utility Dive. The other important factor is the reliability value storage offers. That is harder to pin down.

There are few significant state level policy initiatives to establish the value of storage in utility resource planning, North Carolina Clean Energy Technology Center (NCCETC) Senior Manager of Policy Research Autumn Proudlove, lead author of the Center’s national policy quarterlies, told Utility Dive.

“Some states have recently added requirements for utilities to consider storage in their planning processes,” she said. “Washington has probably gone farthest in moving toward sub-hourly modeling, which is where the value of storage can be captured.”

“Utilities are starting to realize their planning models aren’t set up to answer storage questions very well.”

Ryan Hledik

Principal, The Brattle Group

NCCETC has not identified any state policy initiatives for including the resilience value of storage or compensation to storage for the multiple grid services it can provide in the planning process, Proudlove added.

The storage value proposition depends on its being compensated for full value, and much of that depends on the system’s resources and “net load shape,” Brattle Principal Ryan Hledik told Utility Dive. “Utilities are starting to realize their planning models aren’t set up to answer storage questions very well.”

Their planning models “sort load into groups of similar load hours and planning decisions are made around those groups,” Hledik said. “That approach made sense when the utility was dispatching mostly thermal generation, but not with high levels of variable wind and solar and the potential to use cost-effective battery storage.”

Many of Brattle’s client utilities “are moving to long-term planning tools that better represent how storage and renewables interact on the system,” Hledik said.

Planning tools

Future resource mix planning by utilities is a complicated process of developing scenarios that forecast generation, transmission, and other system needs, Janice Lin, CESA Co-Founder/Director Emeritus and Founder/CEO of energy consultancy Strategen, told Utility Dive.

Because battery storage can be generation or load and can provide multiple value streams, “accuracy requires granular modeling of every hour of the year,” she added. “Current modeling software leaves a lot of room for innovation.”

The “fundamental planning question is what resources are needed to meet system loads now and long-term.”

Roderick Go

Senior Consultant and Technical Manager, Energy and Environmental Economics

Modeling tools are emerging to help system planners consider the many factors that should be considered in determining the right amount of storage in a future resource mix, leading resource planning authorities told the CESA webinar audience.

The “fundamental planning question is what resources are needed to meet system loads now and long-term,” Energy and Environmental Economics (E3) Senior Consultant and Technical Manager Roderick Go said during the webinar.

Utility incentives, mandates, and cost declines are driving present demand for battery storage, Go said. “Longer term, regulatory changes, system changes, and the evolution of the market will bring more storage onto the system.” Innovative modeling software is a “very competitive space,” and rising renewables penetrations “have increased interest in concepts like ELCC.”

ELCC is a detailed calculation of a resource’s reliability value. A dispatchable fossil fuel plant would likely have a 100% ELCC because it is theoretically available almost any time a system’s reliability is threatened.

Granular modeling shows that battery storage’s value rises with a system’s renewables penetration but the value falls as peak demand is flattened, Go said. In general, a storage penetration that decreases peak load up to 15% gives battery storage an 80% to 100% ELCC value because it is usually available throughout peak demand.

With a 15% to 30% peak load reduction, storage’s ELCC value “declines quickly” because it is likely to have already been used to flatten the peak and no longer be available to meet a reliability need, he added.

With a greater than 30% peak load reduction, battery storage of less than 12 hours duration “has limited value” for long term reliability because it would have been used up meeting peak needs no longer be available, he concluded.

Consultant Astrape’s studies of the Southwest Power Pool and California power systems essentially confirmed the ELCC quantification described by E3’s Go, Astrape Junior Consultant Chase Winkler said during the webinar.

NREL and the Los Angeles Department of Water and Power (LADWP) are developing what they and other stakeholders said is a “best practice” approach for planning to meet [the utility’s] 100% renewables by 2045 goal, LADWP spokesperson Carol Tucker emailed Utility Dive.

The Scalable Integrated Infrastructure Planning initiative at NREL is developing that best practices suite of tools to address the “unique aspects of storage” with “an hourly dispatch profile,” Steinberg told the CESA webinar.

NREL’s “iterative approach” begins with “capacity expansion modeling” to determine “what to build and where and when to build it,” Steinberg said. It next does hourly “production cost modeling,” he added. Day-ahead, hourly, and sub-hourly scenarios are iterated back through capacity expansion modeling to reach the most cost-effective and reliable resource mix.

Resource adequacy planning, the next step in the process, is “to meet the one-day-in-10 years reliability standard,” and, if necessary, NREL’s process iterates all three steps to achieve the most cost-effective resource adequacy, he said. Finally, detailed “power flow modeling” ensures “the physics of the grid” is protected. Any threat to reliability starts the process over.

To accurately include battery storage’s capacity value in these planning processes, many are advocating for the use of the ELCC, the webinar speakers agreed. But the ELCC’s role in planning is controversial.

The ELCC controversy

As utilities and others work to determine the right amount of storage, ELCC is supposed to identify the value of storage for resource planning purposes, but some argue it is not the best tool for that.

ELCC has become part of integrated resource planning (IRP) for the California Public Utilities Commission (CPUC), the commission’s Energy Division Head Edward Randolph recently told Utility Dive. Recent ELCC calculations that show all resources’ reliability values will likely “increase procurements of storage, solar with storage, demand response, and other resources that can better meet peak demand,” he said.

There is, however, controversy over “whether the ELCC supports adoption of the lowest cost, most reliable resources to meet the state’s needs and goals,” former CPUC Energy Advisor Matthew Tisdale of Gridworks, which is currently assessing the commission’s IRP process, told Utility Dive.

The ELCC is a complex calculation, but it may overlook some resources’ value, including that of storage, in comparison to their cost, Tisdale and other stakeholders said.

“Modeling is not a substitute for judgment.”

Matthew Tisdale

Executive Director, Gridworks

Concerns were raised about the current New York Independent System Operator (NYISO) approach to storage capacity value and some stakeholders proposed an ELCC, according to a December 6, 2018, NYISO workshop presentation.

The stakeholders want “pricing and investment signals” for balancing and reliability services from storage to come from New York’s wholesale energy market, NYISO’s May 2019 draft response reported. Though ELCC can be used, NYISO found it may be too dependent on administrative assumptions or require “sophisticated” calculations that make planning too “opaque.”

Astrape raised similar concerns about the Southwest Power Pool’s ELCC and federal regulators opened a proceeding in October 2019 to study the PJM Interconnection’s ELCC, ESA’s Burwen said. “The concept is evolving. Even the granularity of hourly modeling doesn’t fully capture the value of batteries’ flexibility in the real world.”

A June 2019 NREL study proposed an alternative to the ELCC. ELCC simulations “can be computationally intensive when considering a large number of scenarios,” the study reported. A much simpler but equally accurate approximation can specifically target the battery storage needed to reduce “net peak demand,” the paper suggested.

With so many competing interests and “an extremely complicated analysis based on uncertainty well into the future, it is not surprising that people disagree” about planning elements like ELCC, Gridworks’ Tisdale said. “Modeling is not a substitute for judgment.”

But sophisticated, detailed modeling can identify “where the incremental benefits from more storage additions equal the cost of adding storage to the system,” Brattle’s Hledik said. That point “is the maximum amount of that type of storage technology to deploy.”

Technologies, resource prices, and other power system drivers “are evolving fast,” Hledik added. “To avoid overlooking critical changes, [resource] planning should seriously address three or four plausible and frequently updated futures that are very different.”

Battery storage adds those kinds of challenges, “but it is not a hypothetical anymore and we are making important progress in understanding how to use it.”