Ari Gold-Parker is an associate director, Dan Aas is a partner, Arne Olson is a senior partner and Amber Mahone is the managing partner at Energy + Environmental Economics (E3)

Interest is growing in electrification as the lowest cost and lowest risk option for decarbonizing much of the building sector. In addition to the incentives and tax credits for building electrification included in the federal Inflation Reduction Act, several states have begun enacting policies to promote the adoption of electric heat pumps and slow the growth of natural gas distribution systems.

In California, policymakers are piecing together a plan to achieve high levels of building electrification, including efforts to develop new upfront incentives, modernize electric rate designs, update the state’s building code and consider emissions standards for new appliances. However, as these initiatives begin to take root, an important question looms ever larger: what to do about our extensive natural gas infrastructure?

California has a massive gas system with over 200,000 miles of gas “distribution” pipelines – small-diameter pipes that move gas through neighborhoods and deliver it to buildings. Collectively, California’s gas distribution pipelines cost over $20 billion to install, are financed by gas ratepayers over roughly 60 years, and we have paid off less than one third of their costs. These costs will pose an increasing challenge as building electrification advances, as gas system costs will be spread across fewer customers and a lower volume of gas sales. As a result, remaining customers could face large increases in their gas rates. Low-income homeowners, who cannot afford electric alternatives, and renters, who cannot elect these alternatives, will be most vulnerable to these gas rate increases.

The long-term gas system cost challenge is a thorny issue for the energy transition. New research completed for the California Energy Commission shows how “targeted electrification and gas decommissioning” could help manage costs on the gas system. In this approach, building electrification would be targeted to specific locations to avoid a gas pipeline replacement project. If implemented at scale across the state, we estimate that targeted electrification and gas decommissioning projects could reduce the gas revenue requirement — the total funds collected from gas customers to pay for the gas system — by $100 million per year in early years and by over $2 billion per year by 2045.

This strategy will not be a “silver bullet” to solve the state’s long-term gas cost challenge. Even where targeted electrification projects are cost-effective, the timing and scale for these projects will be limited by the pipeline replacement schedule and by hydraulic feasibility for decommissioning.

At the California Public Utilities Commission, the Long-term Gas Planning proceeding is beginning to focus on planning for a transition of California’s natural gas system. In February, the CPUC proposed new scope for Phase 3 of the proceeding, including the identification and collection of key gas system data and the consideration of geographically targeted approaches to building electrification. The CPUC also issued a joint agency staff paper on gas transition planning that draws on our work on targeted electrification. This proceeding will be an important opportunity to consider the role of targeted electrification as part of a portfolio of strategies to decarbonize gas customers and manage gas system costs.

The gas infrastructure cost challenge

While California’s long-term goal is to transition gas customers to electricity or clean fuels, continued investment in the gas system is needed to support safe and reliable operations. California’s gas utilities replace hundreds of miles of distribution pipeline per year, focusing on pipelines with the highest risk of leakage or failure. These projects typically cost between $2 million and $6 million per mile of distribution main.

Our research for the California Energy Commission explored the cost-effectiveness of targeted electrification and gas decommissioning to avoid specific gas pipeline replacement projects at eleven sites in the San Francisco Bay Area. Our cost-effectiveness analysis considered participant, gas ratepayer, electric ratepayer and total cost perspectives using site-specific estimates of gas infrastructure avoided costs and energy consumption data for 1,500 customers.

We found that all eleven of the candidate projects would generate net benefits from a total cost perspective. Thus, if projects like these could be successfully implemented — which remains a big ‘if’ given upfront cost barriers, customer preferences and regulatory challenges — these projects would help manage the long-term gas cost challenge.

Customers participating in a targeted electrification project will face a significant funding gap for the upfront costs of building electrification, even after accounting for existing federal, state and utility incentives. These upfront costs, along with the costs to upgrade the electric panel and service where necessary, remain a significant barrier to customer adoption. One potential option to address the funding gap would be to repurpose savings from avoided gas pipeline replacement to fund the associated building electrification projects. However, this approach would reduce the long-term savings to gas ratepayers and thus does not help mitigate the cost challenge for remaining gas customers.

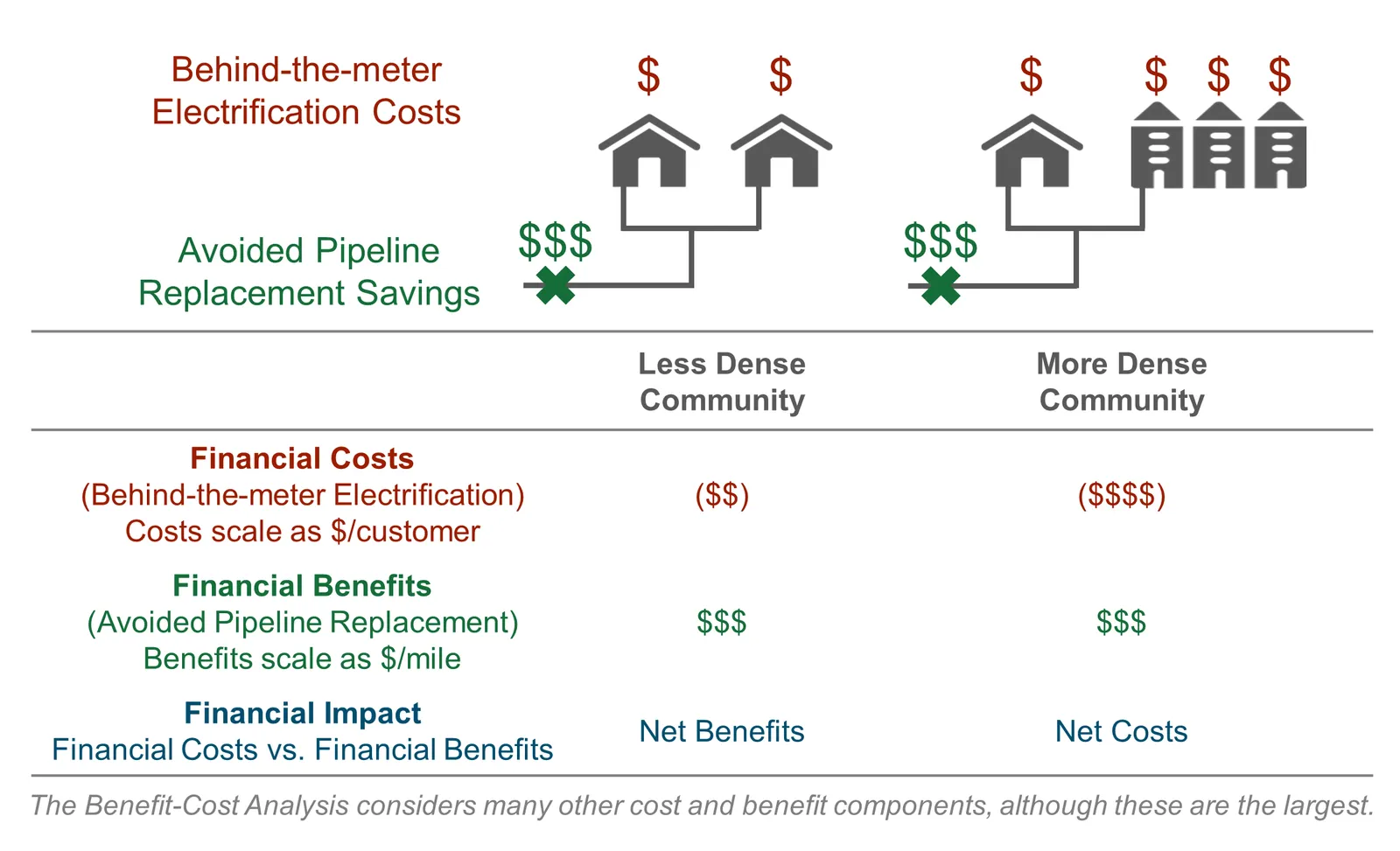

We also found that targeted electrification projects will likely be more cost-effective in less dense communities, i.e., sites with fewer gas customers per mile of gas main. The eleven candidate sites in the Bay Area are much denser — in terms of customers per mile — than PG&E’s service territory on average, indicating that projects in other regions of California could be more cost-effective. In other words, pruning the gas distribution system in the more rural parts of the service territory is likely to be a more cost-effective strategy than pursuing gas decommissioning projects in the denser urban core (Figure 1).

Figure 1: Schematic illustrating the finding that less dense sites are likely to see better overall cost-effectiveness for targeted electrification and gas decommissioning.

Permission granted by E3

Cost-effectiveness in other regions

The cost-effectiveness picture for targeted electrification and gas decommissioning will look different in other places. PG&E has one of the densest gas service territories in the U.S., and less dense utilities would see lower total electrification costs for decommissioning a mile of gas main. Conversely, PG&E has relatively high gas pipeline replacement costs, so other utilities may see lower savings from decommissioning a mile of gas main. Climate will also play an important role in the cost-effectiveness of these projects. Relative to California, colder climates may see greater upfront costs to install larger and more efficient heat pumps. Electric system capacity costs may also be higher in cold climates, where electrification will increase peak loads on the distribution system and/or on the bulk system.

There is also an interesting consideration for planning these kinds of projects in colder climates. Our work in Massachusetts has shown that pathways that employ a mix of all-electric and dual-fuel (“hybrid”) heat pump systems may help limit severe peak load impacts on the electric grid and their associated costs. Under this kind of pathway, all-electric equipment could be geographically targeted in sites that are suitable for gas decommissioning, while dual-fuel systems could be prioritized in locations where full electrification is more challenging and where the gas infrastructure is newer and gas system investments are not needed.

Regulatory and policy considerations

Regulatory and policy changes will be necessary for targeted electrification and gas decommissioning to achieve a scale that would support meaningful cost savings for gas ratepayers. One step in this direction would be for the CPUC to require gas utilities to develop strategic long-term plans to meet decarbonization goals. Other suggestions include creating a longer-term planning process for gas capital projects to support site identification, developing better data and planning tools to identify candidate sites, and pursuing legislative reforms to the obligation to serve. These topics should be considered in the new phase of the CPUC’s Long-Term Gas Planning proceeding.

Another key lesson from this work is that coordinated planning is needed between gas and electric utilities. Both utilities must contribute data to enable site identification and must support the physical implementation of a project, and they may both provide or coordinate funding and incentives. These efforts may be difficult to achieve even within a single utility company and will be much more challenging where gas and electric utilities are different. Regulators and policymakers should take steps to support this necessary coordination.

As California continues to progress on plans for building electrification, we must also plan for managing our state’s extensive gas distribution system. Targeted electrification is a piece of the puzzle, but other measures will also be needed to reduce gas system investment and mitigate long-term cost pressures. It’s time to develop long-term plans for the gas system that put these pieces together.